26+ Yearly mortgage calculator

Free mortgage calculator to find monthly payment total home ownership cost and amortization schedule with options for taxes PMI HOA and early payoff. Five year fixed rate for existing customers of 300.

Timeline Infographics Timeline Design Infographic Infographic Design

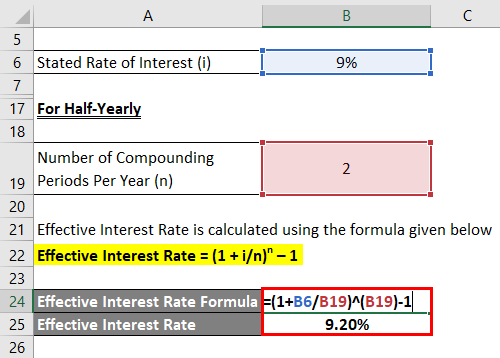

Daily monthly quarterly half-yearly and yearly compounding.

. Use the calculator below for mortgage loans in the United States. The first one makes extra payments at the start of the term while the second one starts making extra payments by the sixth year. The state tax is 50 cents per 100 of mortgage debt plus an additional special tax of 25 cents per 100 of mortgage debt.

365 times per year. If you have a variable-rate mortgage this calculator tells you how your payments will change when the BoC hikes rates. 24 times per.

26 times per year. Borrowers are still responsible for property taxes or homeowners insuranceReverse mortgages allow older. Estimate your monthly payments with PMI taxes homeowners insurance HOA fees current loan rates more.

Be sure to select the correct frequency for your payments to calculate the correct annual income. Check out the webs best free mortgage calculator to save money on your home loan today. After year three a Managed Variable Rate 80-90 LTV of 39 APRC 397 applies however there are also Fixed Rate options that would be available as an alternative to this Managed Variable Rate eg.

The main difference between APY and APR is that the former considers yearly compounded interest while APR always means a monthly period. Extra Payment Mortgage Calculator By making additional monthly payments you will be able to repay your loan much more quickly. Many employers give employees 2 weeks off between the year end holidays and a week of vacation during the summer.

Use the mortgage repayment calculator on this page to get a graph table and summary of your estimated home loan repayments and total interest based on your home loan amount your loan type and the interest rate you think youll be paying. We multiply your monthly amount by 12 to get a yearly value then divide either by 26 for. We also generate graphs summaries of balances payments and interest over the life of your mortgage.

Each year has 52 weeks in it which is equivalent to 26 biweekly pay periods. You can change the first payment date and the amortization schedule by monthly or yearly. A complete amortization schedule will.

Enter the loans original terms principal interest rate number of payments and monthly payment amount. Mortgage Calculator with Lump Sums. The calculator lets you determine monthly mortgage payments find out how your monthly yearly or one-time pre-payments influence the loan term and the interest paid over the life of the loan and see complete.

This calculator will help you to determine the principal and interest breakdown on any given payment number. You may also enter extra lump sum and pre-payment amounts. Daily monthly or yearly interest compounding.

This mortgage calculator gives a detailed breakdown of up to two mortgages and calculates payment schedules over your full amortization. If the property is located in a city or town that has mortgage tax youll pay an additional 25 to 50 cents. 52 times per year.

Our calculator includes amoritization tables bi-weekly savings. New York City Yonkers and several other cities also impose a local tax on mortgages in those jurisdictions. With 52 weeks in a year this amounts to 26 payments or 13 months of mortgage repayments during the year.

An interest-only mortgage means you only pay the interest and once the loan is over eg 25 years after you took it. Calculate How Much of Each Debt Payment Goes to Principal or Interest. Provides graphed results along with monthly and yearly amortisation tables showing the capital and interest amounts paid each year.

Important information assumptions. In this calculator you can inclue investments annuities alimony government benefit payments in the other income sources. We used the calculator on top the determine the results.

An amortization schedule is a complete table of periodic loan payments showing the amount of principal and the amount of interest that comprise each payment until the loan. 30-Year Fixed Mortgage Principal Loan Amount. The following table highlights the equivalent biweekly salary for 48-week 50-week 52-week work years.

To show you how this works lets compare two 30-year fixed mortgages with the same variables. The land mortgage calculator returns the payoff date total payment and total interest payment for your mortgage. Mortgage Calculator excel spreadsheet is an advanced mortgage calculator with PMI taxes and insurance monthly and bi-weekly payments and multiple extra payments options to calculate your mortgage payments.

Today rates went up by 025 of a percentage point. Extra Yearly Pay from. Extra One-time Pay in.

This method is mainly for those. A repayment mortgage means that over the length of the loan you will repay the full amount you borrowed as well as some interest. Repayments are based on a three year fixed rate of 295 APRC 371.

The loans are typically promoted to older homeowners and typically do not require monthly mortgage payments. A reverse mortgage is a mortgage loan usually secured by a residential property that enables the borrower to access the unencumbered value of the property. Also offers loan performance graphs biweekly savings comparisons and easy to print amortization schedules.

In addition you can include negative interest rates and inflation increases as part of your calculation. These figures are exclusive of income tax. Our compound interest calculator includes options for.

Use our comprehensive online mortgage calculator which shows the monthly interest only and repayment amounts on a mortgage.

Solid Patio Covers Outdoor Living In Style Backyard Patio Covered Patio Outdoor Living

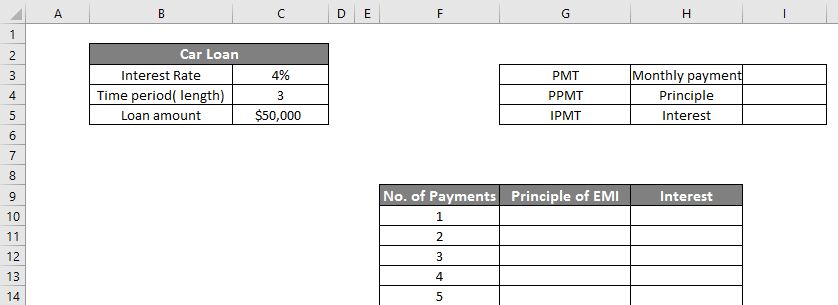

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

1

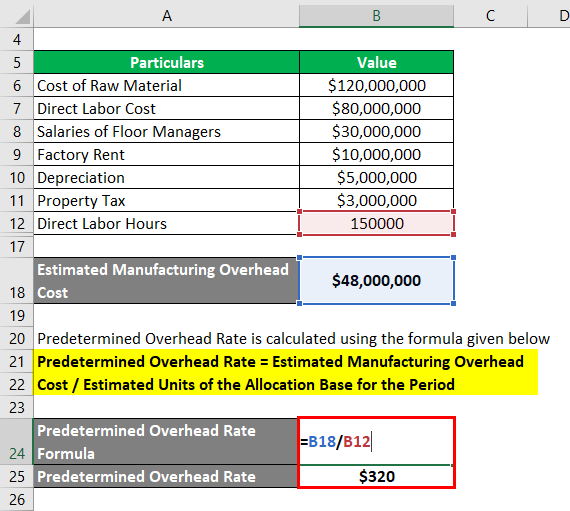

Predetermined Overhead Rate Formula Calculator With Excel Template

1

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Free 9 Sample Retirement Withdrawal Calculator Templates In Pdf

Effective Interest Rate Formula Calculator With Excel Template

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Maturity Value Formula Calculator Excel Template

Retirement Calculator Spreadsheet Retirement Calculator Budget Template Simple Budget Template

1

1

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Free Google Docs Budget Templates Smartsheet Household Budget Template Budget Template Budget Template Free

Excel Mortgage Calculator How To Calculate Loan Payments In Excel